Doing business in Moldova: Payroll, Benefits & Taxes

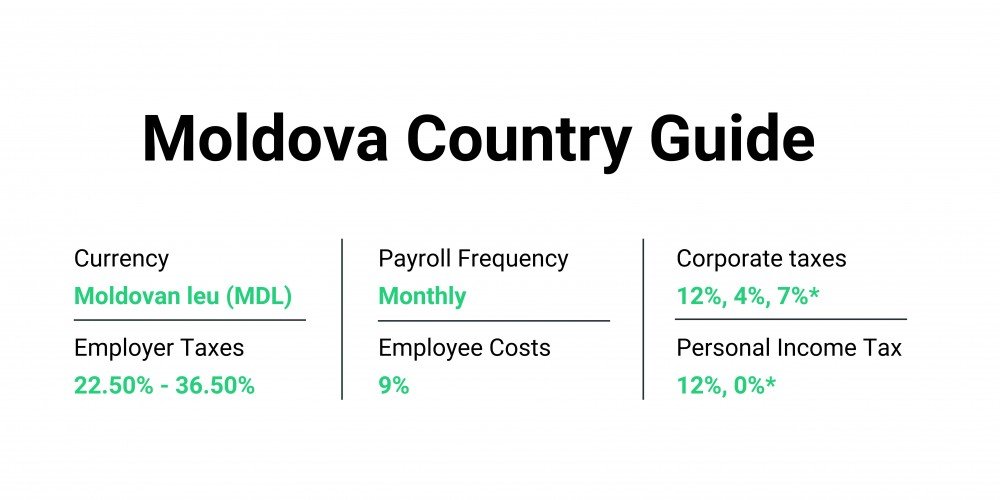

Moldova's strategic location, skilled workforce, and competitive tax regime make it attractive for businesses looking for outsourcing destinations. Doing business in Moldova requires careful consideration of various legal and financial aspects, including payroll and business taxes.

Bellow you can find a general overview of what it means to do business in Moldova in terms of taxes and compliance.

Standard Salary Taxes in Moldova

While there is a standard taxation system that applies to many businesses in Moldova, depending on your activity complexities arise in areas like employee benefits, minimum wage adjustments, and industry-specific regulations. Professional consultation ensures accurate deductions and avoids penalties.

| Social Security Contributions | Employer rate | Employee rate |

|---|---|---|

| Compulsory Social Security Tax, including state pension | 24% | - |

| Compulsory Health Insurance |

- |

9% |

| Personal Withholding Income Tax | - | 12% |

| TOTAL | 24% | 21% |

Meal Tickets: Value exceeding MDL 35-70 subject to PIT.

Personal Costs Covered by Employer: Subject to PIT.

Cancellation of Employee Debts: Subject to PIT.

Company Taxes in Moldova

Profit Tax: 12% on net profit.

Dividend Tax: 6% on gross dividends distributed to residents

Value Added Tax (VAT): Standard rate of 20%. Reduced rates apply to certain goods and services.

Minimum and Average Wage

Minimum Wage: MDL 5500 (± €275) per month (as of January 2025).

Average Wage: MDL 16100 (± €805) per month (as of January 2025).

Payroll Cycle

Monthly: Employees are typically paid on the 25th or on the last business day of each month. Some companies pay salaries on the 15th of the next month, for the current month.

Penalties: Late payments subject to penalties.

Working Hours

Standard: 40 hours per week, 8 hours per day, Monday to Friday.

Reductions: Possible in hazardous workplaces through contracts or collective bargaining agreements.

Overtime

Rate: Overtime payment is mandatory. 150% for first 2 hours, 200% for remaining hours. Employees can work a maximum of 4 hours of overtime a day and a 120 hours per calendar year.

Limit: 120 hours per year, may be increased to 240 hours through collective bargaining agreements.

Restrictions: Under 18, pregnant women, and medically unfit employees cannot work overtime.

Leave

Annual Leave: 28 calendar days + public holidays. Both full-time and part-time employees are entitled to 28 calendar days of paid time off. Vacation entitlement accrues monthly at 2.33 calendar days per month. Employees are entitled to take paid annual leave after six months of employment without absence.

Pro-rata leave: Granted after 6 months of continuous work.

Holiday Allowance: At least equivalent to wages during leave.

Public Holidays in Moldova:

|

1 Jan 2025 |

Wednesday |

New Year’s Day |

|

7 Jan 2025 |

Tuesday |

Orthodox Christmas Day |

|

8 Jan 2025 |

Wednesday |

Orthodox Christmas Day holiday |

|

8 Mar 2025 |

Saturday |

International Women’s Day |

|

20 April 2025 |

Sunday |

Orthodox Easter Sunday |

|

21 April 2025 |

Monday |

Orthodox Easter Monday |

|

28 April 2025 |

Monday |

Memorial Day/ Parents' Day |

|

1 May 2025 |

Thursday |

International Day of Solidarity of Workers |

|

9 May 2025 |

Friday |

Victory Day |

|

1 Jun 2025 |

Sunday |

International Children’s Day |

|

27 Aug 2025 |

Wednesday |

Independence Day |

|

31 Aug 2025 |

Sunday |

Language Day |

|

14 Oct 2025 |

Tuesday |

Chisinau Church Day |

|

25 Dec 2025 |

Thursday | Christmas Day |

Sick Leave: 5 paid days per year employer-funded based on sickness certificate, the difference is then state-funded. Employees are entitled to paid sick leaver for up to 210 days.

Maternity Leave: 70 days before birth, 56 days after. The employee will receive 100% of their avg salary from the last 12 months of employment during this period, and Social Security Authority will be responsible for this pay. After this, the leave can continue and is partially paid until the child turns 3 (duration depends on seniority, job role, and insurance scheme).

Paternity Leave: 14 days after birth.

Parental Leave: Employees are entitled to up to 36 months of parental leave. Both parents can decide how to distribute the time off, which should be taken after paternity and maternity leave. Either parent can take parental leave. Social Security will pay the salary during this period.

Bereavement Leave: 3 days for direct relatives after 6 months of service.

Termination

Reasons: voluntarily by employee, by mutual agreement, unilaterally by employer based on probation period outcomes, performance, disciplinary, expiration of the contract.

Notice Period: 30 days or 60 days for employer, 14 days for employee.

Severance Pay: Linked to length of employment and is generally applicable only if the employee worked for more than 1 year. It is usually calculated as 1 week of salary for every year worked. At least 1 month’s salary is due if the reason for termination is economic.

Probation Period

Maximum: minimum 30 days, maximum 180 days. Generally three months for non-management roles, and six for management roles, depending on the responsibilities.

No extensions or renewals.

Visa and Work Permits

Residence permit: Required for stays exceeding 90 days.

Work permits: May be necessary depending on nationality and job role. Consult official resources for details.

Moldova citizenship: Possible after meeting specific requirements (investment, naturalization).

Rules of Employment Agreements and Documentation

Written contracts: Mandatory in Romanian, it can be in two languages with one in Romanian.

Specific content: Required by law (wages, working hours, leave, etc.).

Records: Employers must maintain personnel records.

Moldova Tax Benefits for IT Sector, BPO, R&D

The IT sector has emerged as a vital driver of economic growth in the Republic of Moldova, becoming the fastest-growing industry and a top priority for the Government. Over the past years, the industry turnover has surged threefold, propelling IT services to the forefront of the country's export sector.

Despite competition from other emerging countries in the IT sector, Moldova's IT field benefits from significant incentives provided by Moldova IT Park. This specially established platform aims to support and streamline investment initiatives while fostering the development of the tech sector. It achieves this through unified state reporting and simplified tax arrangements, including a flat tax rate of 7% on turnover.

Thus, IT businesses in Moldova pay only 7% tax which replaces many other taxes due by companies, including:

Corporate Profit Tax (ranging from 4% to 12%),Personal Income Tax (12%),Salary taxes for both employees and employers (around 36%).

If you're interested to learn more about IT tax benefits in Moldova read our article here.

Don't navigate Moldova's business landscape alone! Schedule a consultation with our experts today!

Unlock the full potential of your business in Moldova with expert guidance. Our team of professionals is well-versed in the intricacies of payroll, taxation, and legal requirements specific to your industry.

Here's how we can help:

- Simplify payroll and tax compliance: Ensure accurate calculations, meet deadlines, and avoid penalties.

- Navigate complex regulations: Understand legal requirements for business operations in Moldova.

- Optimize your tax strategy: Leverage available incentives and minimize tax liabilities.

- Gain peace of mind: Focus on your business while we handle the administrative burdens.

Schedule your online consultation today and:

- Discuss your specific business needs and goals.

- Get tailored advice from our experienced professionals.

- Ask questions and receive clear, concise answers.

Don't wait! Contact us now and take the first step towards a successful business venture in Moldova. We look forward to helping you achieve your business goals in Moldova!